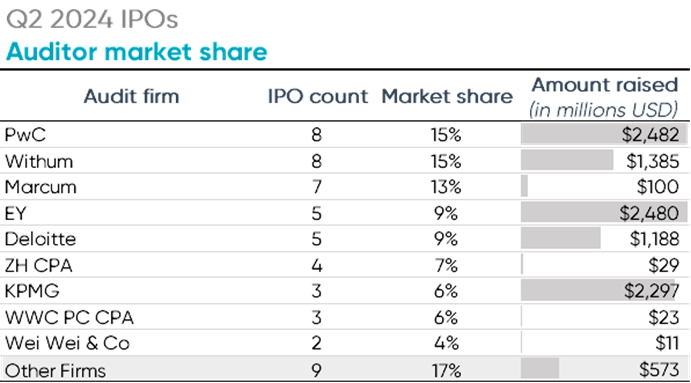

Of the 54 companies that went public in the second quarter of 2024, PwC and Withum audited 16 of them—eight each—more than any other audit firm, according to a new analysis from Ideagen Audit Analytics.

Overall, 18 different firms audited the 54 new initial public offerings, which raised a combined total of $10.5 billion. Coming in behind PwC and Withum was Marcum, which had seven new clients—the same total as in Q1.

PwC also ranked first in terms of gross proceeds with their eight Q2 2024 IPO clients raising a combined total of $2.482 billion, according to Audit Analytics. EY’s five IPO clients raised nearly the same amount, totaling $2.480 billion in proceeds. Q1 IPO audit client leader KPMG only audited three in Q2, with combined proceeds topping out at just under $2.3 billion.

Unlike the first quarter of the year which had zero special-purpose acquisition company IPOs, there were 10 in Q2. Of the four firms that audited the 10 SPAC IPOs, Withum led with seven, meaning all but one of the eight IPOs audited by the top 25 accounting firm involved SPACs. MaloneBailey, Enrome, and Marcum each audited one SPAC IPO, according to Audit Analytics.

Total IPOs and gross proceeds both increased in Q2 with eight additional IPOs and an increase of $1.6 billion in proceeds from Q1. Compared to last year’s second quarter, total IPOs increased by 20, or 59%, while IPO proceeds increased by about 43%, Audit Analytics said.

Forty-four of the 54 IPOs in Q2 were traditional IPOs. There was only one company that raised more than $1 billion in proceeds, known as a “unicorn IPO.” Viking Holdings Ltd., a travel company specializing in cruises, announced the closing of its traditional IPO on May 3, and raised approximately $1.54 billion in proceeds.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs